Case Study

LazAI

- Deep Tech & AI, Blockchain Technology

Overview

LazAI is an AI application layer pioneering Web3-native AI infrastructure, focusing on decentralized AI agents and verifiable data tokens (DATs). The company operates at the critical intersection of decentralized finance and artificial intelligence.

The Challenge: Maximizing High-Stakes Launches LazAI faced the challenge of achieving maximum strategic exposure for a series of mission-critical milestones: their whitelist campaign, testnet launch, mainnet launch, and key strategic partnerships. Announcements in this highly technical sector often get lost in the noise unless validated by external, high-authority media.

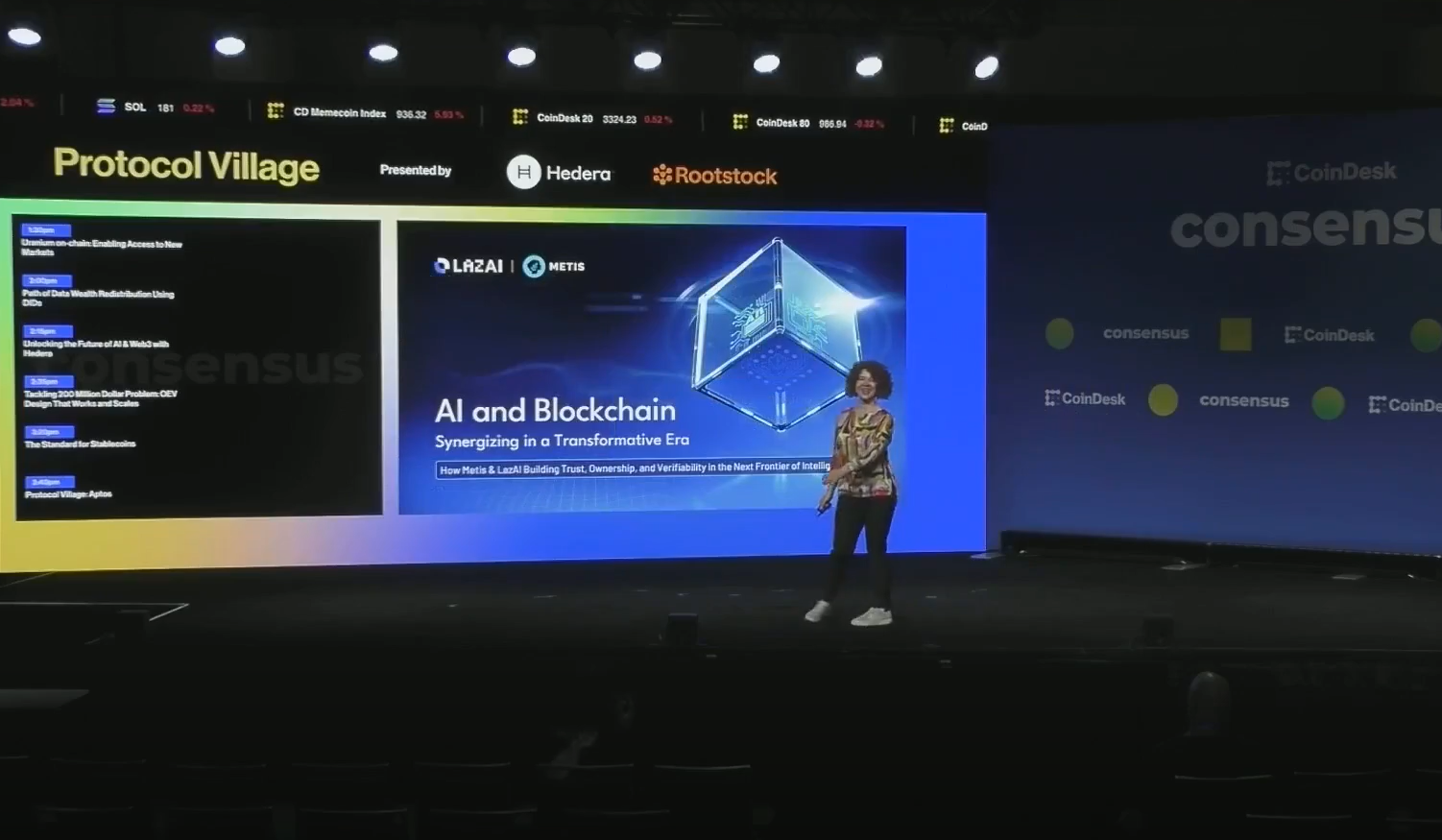

The Goal: BlockWire was tasked with executing a “surge” strategy—doubling down on in-person exposure at major conferences (like Consensus and Token 2049) to secure speaking positions and high-quality interviews that would validate the company’s technical vision for investors.

Strategy

The “In-Person Saturation” & Dual-Credibility Strategy

This strategy focused the majority of effort on maximizing event management and media relations. It allowed LazAI to save significant capital that would have otherwise been spent on high-cost conference sponsorship packages.

Strategic Pillars

- Conference Media (Zero Sponsorship Spend): We aggressively pitched LazAI executives for speaking slots, panels, and on-site studio interviews at major global events. This ensured the executive team’s schedule was filled with top-tier media opportunities, delivering high-impact exposure without the client needing to pay the six-figure fees typical of conference sponsorships.

- Bridge to Finance (TheStreet Integration): The central narrative highlighted the convergence of AI and decentralization. BlockWire leveraged the Roundtable (TheStreetCrypto) asset to secure premium interview placements syndicated to Yahoo! Finance, MSN, and Apple News. This validated LazAI’s financial relevance to a broad audience of affluent investors with an average portfolio size of $1.3 million.

- High-Volume Announcement Velocity: Press release distribution campaigns were executed around each technical milestone (pre-testnet, testnet, LazPad launch). This ensured every update achieved wide-scale saturation across crypto-native and business outlets such as Benzinga, MarketWatch, and TechBullion, driving essential SEO performance and market visibility.

Results

BlockWire successfully transformed physical conference appearances into a high-conversion media engine, delivering both institutional credibility and broad retail visibility for LazAI.

Quantifiable Media & Credibility Wins

-

Mainstream Financial Validation:

Executive Ming Guo secured a featured interview with TheStreetCrypto, resulting in guaranteed syndication on Yahoo! Finance, MSN, and Apple News. This positioned the executive as a recognized voice on the future of AI and blockchain decentralization for a financially sophisticated audience. -

On-Site Media Domination:

The “in-person saturation” strategy produced numerous high-value placements at major events, including:- Coindesk Live (Live appearance)

- Speaking Position (Secured)

- TheStreet (Exclusive interviews and features)

- Genzio Media (Technical on-site interviews with strong viewership)

- CEO.CA (Studio interviews at conferences)

- The Edge of Show (Recurring executive placements across events)

- High-Volume Distribution: Press releases surrounding the pre-testnet launch and LazPad (Play-to-Launch platform) achieved wide coverage across leading financial aggregators and crypto media channels, including Pinion Newswire, TechBullion, Morningstar, Benzinga, and CoinMarketCap.

- KOLs and Crypto X: BlockWire secured executive appearances and content placements with high-reach KOLs and partners like David Gokhshtein, along with strategic visibility boosts through CoinMarketCap.

Conclusion: For a fast-growing AI infrastructure project like LazAI, BlockWire demonstrated the strength of engineered event execution. By treating conferences as high-impact press staging grounds and leveraging Roundtable for mainstream financial validation, we converted complex technical announcements into widespread, authoritative media wins.